2024 Home Office Deduction Schedule C Form – The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . If you made money last year from a side hustle or gig work, tax time can feel stressful and confusing. We’re here to help.Self-employment taxes are the Social Security and Medicare taxes individuals .

2024 Home Office Deduction Schedule C Form

Source : www.nerdwallet.comFree Tax Clinic Bethpage VITA at Touro Law University – Nassau

Source : www.nslawservices.orgHome Office Deduction, Schedule C, Form 1040, Form 8829. How to

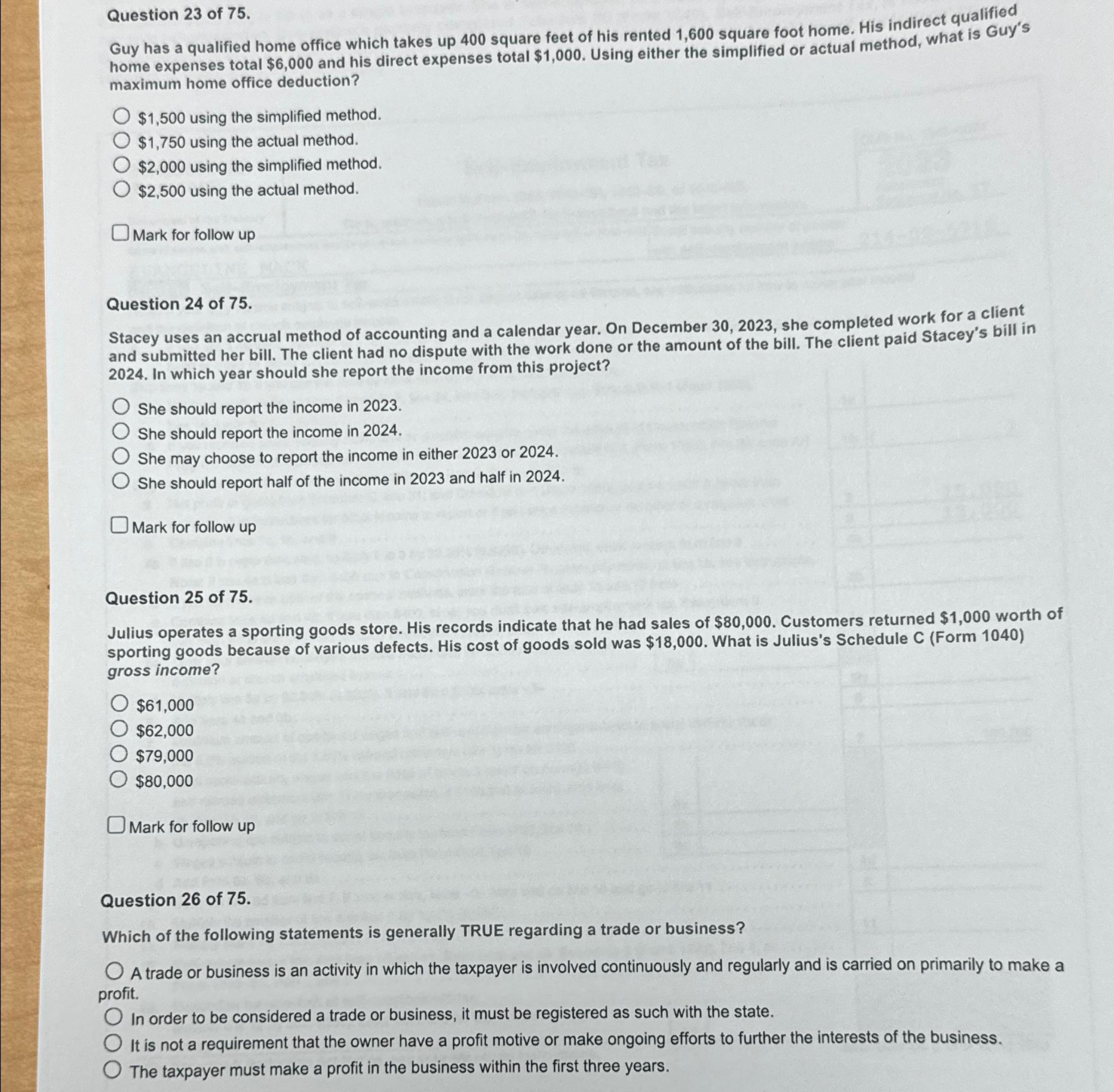

Source : m.youtube.comSolved Question 23 of 75.Guy has a qualified home office | Chegg.com

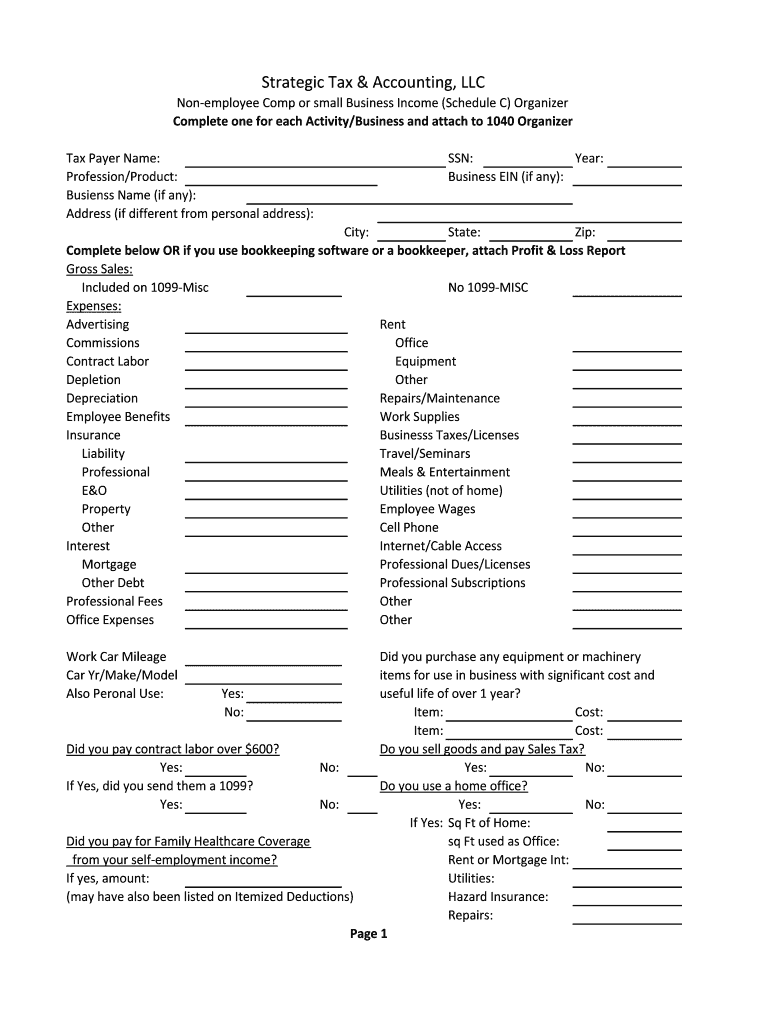

Source : www.chegg.comSchedule c tax form: Fill out & sign online | DocHub

Source : www.dochub.comFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.comIRS Schedule C (1040 form) | pdfFiller

Source : www.pdffiller.comSimplified Option for Home Office Deduction | Internal Revenue Service

Source : www.irs.govIRS Schedule C (1040 form) | pdfFiller

Source : www.pdffiller.com2023 Instructions for Schedule C Profit or Loss From Business

Source : www.irs.gov2024 Home Office Deduction Schedule C Form What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet: While simple math errors don’t usually trigger a full-blown examination by the IRS, they will garner extra scrutiny and slow down the completion of your return. So can entering your Social Security . Income tax deductions are an essential and legitimate way to reduce your tax burden. Every business or individual has a right to minimize its tax bill. However, sometimes people go too far, taking all .

]]>